The world's most advanced Web3 gaming ecosystem. Built on Enjin, powered by Substrate.

%20(1).webp)

.png)

.png)

REWARD RATE

1.2B

NFTS MINTED

3.5M

USERS

1.2M

COMMUNITY MEMBERS

Everything you need to launch user-friendly Web3 games and apps.

%20(1).png)

%20(1).png)

%20(1).png)

%20(1).png)

.webp)

6s

TRANSACTION TIME

$0.0008

AVG. TRANSACTION COST

>2,200

MINTS / TRANSACTION

>5,000

TRANSACTIONS / SECOND

The intuitive marketplace for creators, traders, and developers. Create and trade NFTs in minutes.

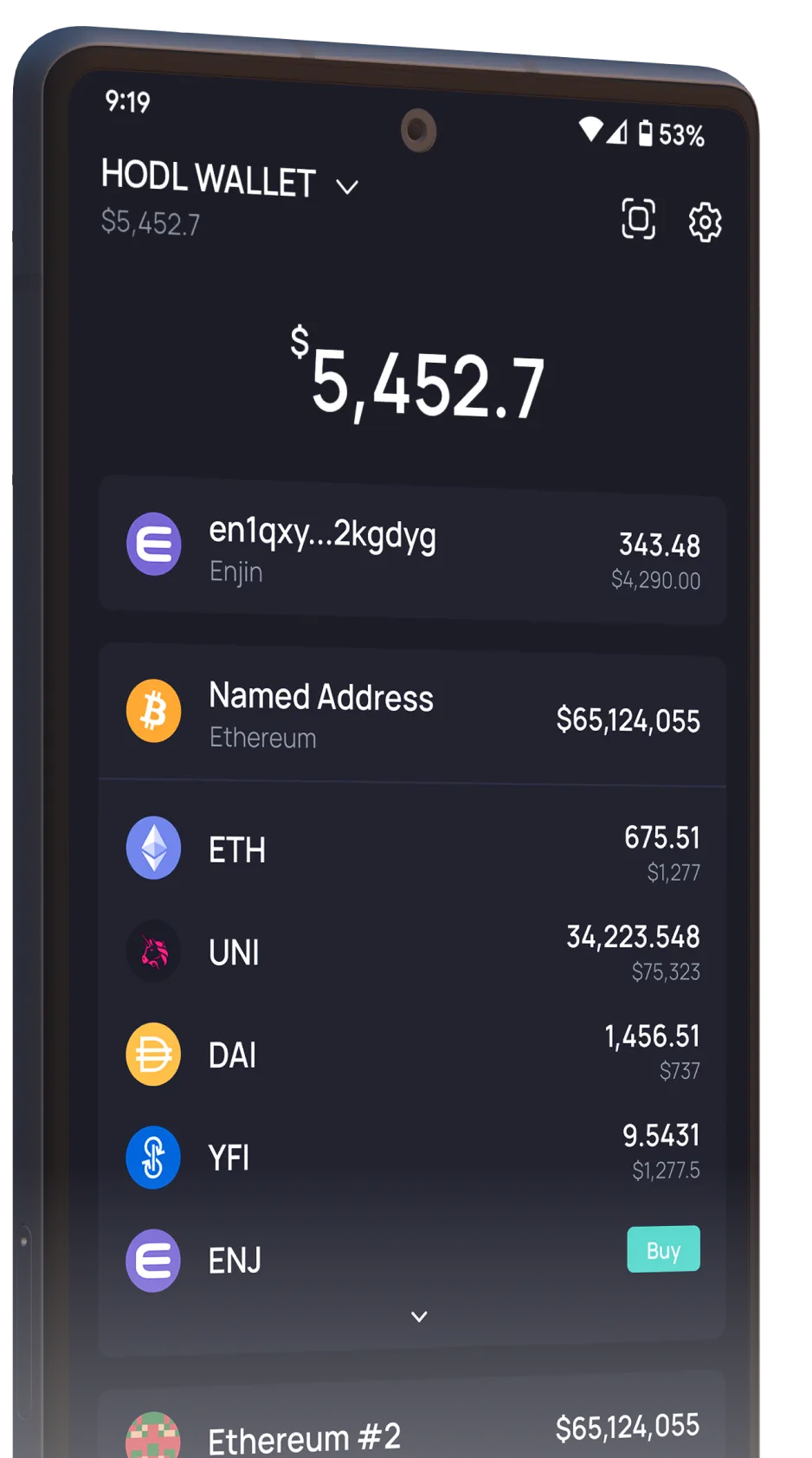

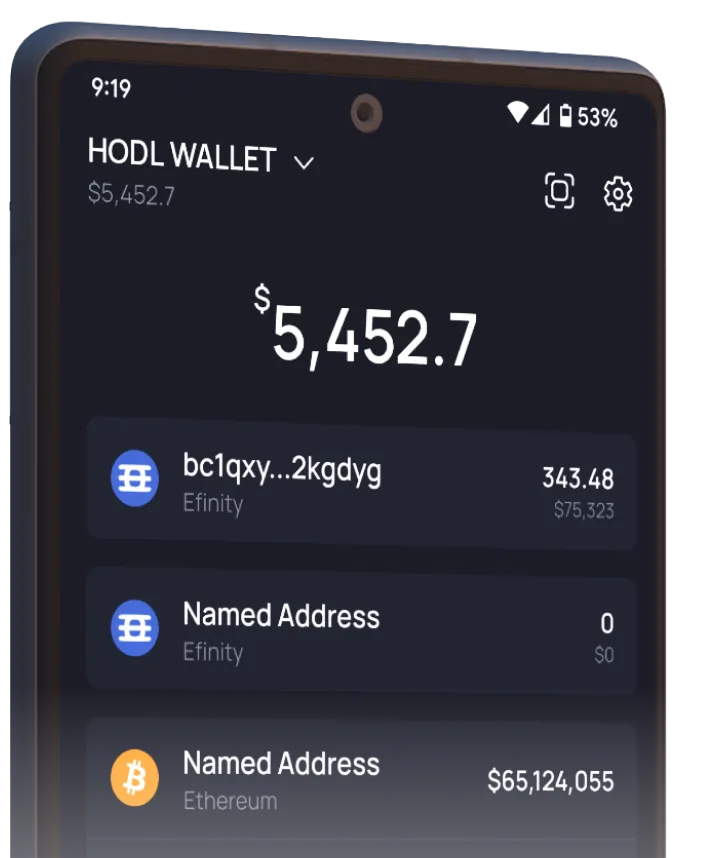

One of the most feature-rich wallets on the market, seamlessly integrated into the Enjin Blockchain, Marketplace, Platform and API.

Everything you need to launch user-friendly Web3 games and apps – integrate NFTs into any piece of technology.

A fun way to send NFTs using QR codes. Effortlessly distribute thousands of items with just a few clicks.

The native coin of the Enjin Blockchain. Custom built for easy integration into games and apps.

Learn More.webp)

.webp)

Enjin nodes are elected using a proof-of-stake consensus model.

The network is secured by validators and stakers instead of miners.

.webp)

.webp)

%20(1).png)

%20(1).png)

.png)

.webp)

.webp)